Minnesota’s

Nonprofit Carshare Network

Own your schedule, not your car. Freedom without car payments. Starting at $10.40/hr.

626,311+

13,272+

Users since 2005

Trips since 2005

Why drive with HOURCAR & Evie?

Save Money

Covers fuel, insurance, and maintenance—and save even more with our affordable plans.

Self-service

Members can grab a car in the app, hop in, and go 24/7! It’s that simple.

24/7 Support

Our Member Services is available to help with active trips.

“Evie makes it easy. I usually take orders for a couple of friends and do a big purchase and delivery trip.”

“I love the fact that I don’t have to worry about gas. It’s more convenient and that’s why I love driving Evie.”

“Between public transit and Evie, I live car-free. Plus, HOURCAR lets me go up north to see the fall colors!”

“I love how zippy the cars feel and how quiet they are. They are super spacious."

“I bike to work 90% of the time. If it's raining or snowing, I drive an Evie.”

“I like to buy groceries from ethnic stores. Evie lets me go conveniently and carry a lot in one run.”

“I use HOURCAR and Evie to get groceries and go to my doctor in the suburbs. Just when I need it!”

“It’s fast and cost-efficient. Only thing I need to do is charge the vehicle at the hub, and that’s it!”

“Evie makes it easy. I usually take orders for a couple of friends and do a big purchase and delivery trip.”

“I love the fact that I don’t have to worry about gas. It’s more convenient and that’s why I love driving Evie.”

“Between public transit and Evie, I live car-free. Plus, HOURCAR lets me go up north to see the fall colors!”

“I love how zippy the cars feel and how quiet they are. They are super spacious."

“I bike to work 90% of the time. If it's raining or snowing, I drive an Evie.”

“I like to buy groceries from ethnic stores. Evie lets me go conveniently and carry a lot in one run.”

“I use HOURCAR and Evie to get groceries and go to my doctor in the suburbs. Just when I need it!”

“It’s fast and cost-efficient. Only thing I need to do is charge the vehicle at the hub, and that’s it!”

“Evie makes it easy. I usually take orders for a couple of friends and do a big purchase and delivery trip.”

“I love the fact that I don’t have to worry about gas. It’s more convenient and that’s why I love driving Evie.”

“Between public transit and Evie, I live car-free. Plus, HOURCAR lets me go up north to see the fall colors!”

“I love how zippy the cars feel and how quiet they are. They are super spacious."

“I bike to work 90% of the time. If it's raining or snowing, I drive an Evie.”

“I like to buy groceries from ethnic stores. Evie lets me go conveniently and carry a lot in one run.”

“I use HOURCAR and Evie to get groceries and go to my doctor in the suburbs. Just when I need it!”

“It’s fast and cost-efficient. Only thing I need to do is charge the vehicle at the hub, and that’s it!”

“Evie makes it easy. I usually take orders for a couple of friends and do a big purchase and delivery trip.”

“I love the fact that I don’t have to worry about gas. It’s more convenient and that’s why I love driving Evie.”

“Between public transit and Evie, I live car-free. Plus, HOURCAR lets me go up north to see the fall colors!”

“I love how zippy the cars feel and how quiet they are. They are super spacious."

“I bike to work 90% of the time. If it's raining or snowing, I drive an Evie.”

“I like to buy groceries from ethnic stores. Evie lets me go conveniently and carry a lot in one run.”

“I use HOURCAR and Evie to get groceries and go to my doctor in the suburbs. Just when I need it!”

“It’s fast and cost-efficient. Only thing I need to do is charge the vehicle at the hub, and that’s it!”

How It Works

1. In the app, sign up for an account and get approval within 3 business days.

2. Pick a plan. The Standard (Everyday) plan is recommended.

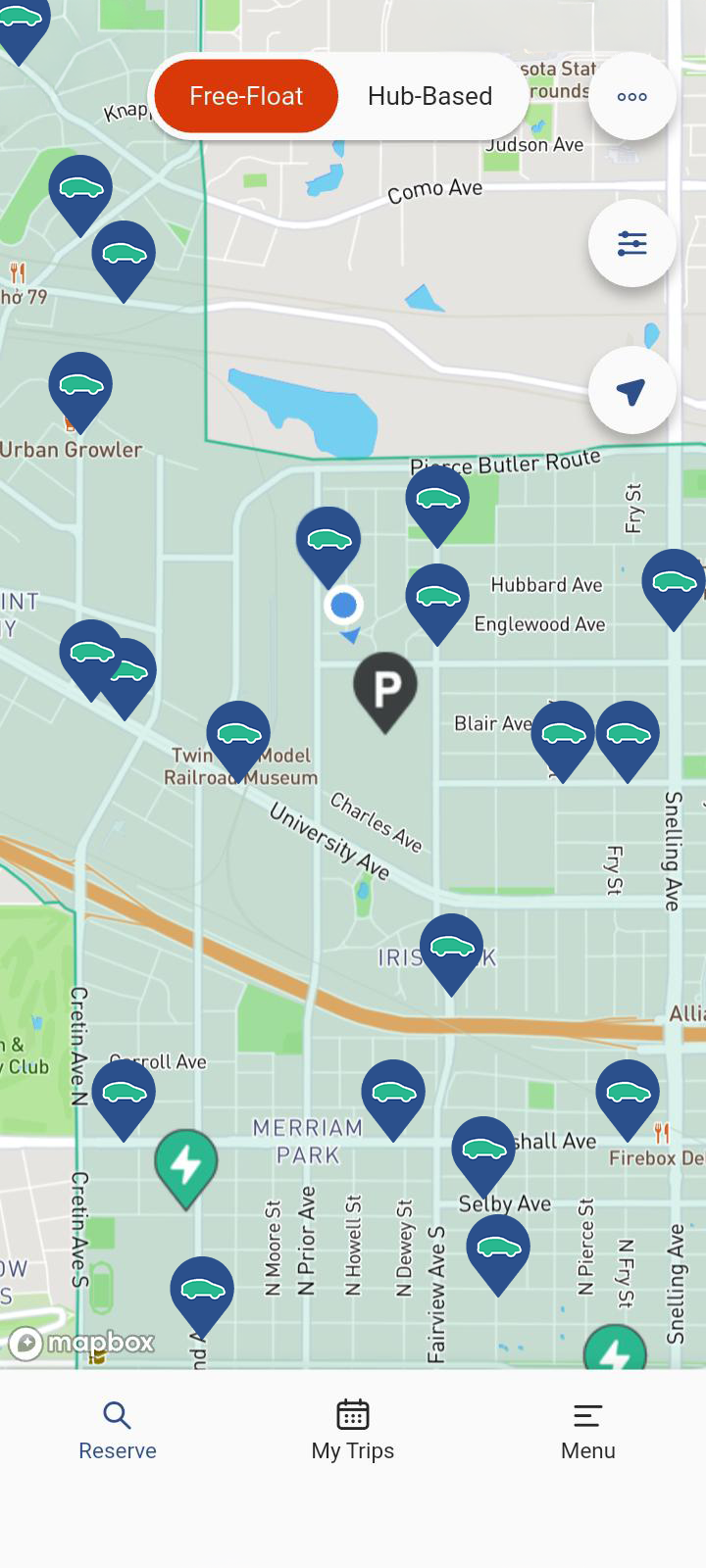

3. Search for nearby cars. Pick a free-float car to start your trip right away, or reserve a hub-based car up to 6 months in advance

4. Start your trip.

OUR PARTNERS

Xcel Energy supports efforts to increase access to electric vehicles in underserved communities. Learn more about how Xcel Energy is helping customers drive electric.